Lithium is a strategic mineral that’s critical for modern technologies, and it’s in high demand globally. Lithium is used in batteries for electric cars, laptops, smartphones, and power tools. Lithium batteries are used in military equipment for power in weapons systems, electronics, and propulsion. They are more relevant because they are lightweight, have a long storage life, and are cost-effective. Scientists and world leaders agree that a sustainable supply of lithium is needed to meet global decarbonisation goals.

Statements about Trump’s plans to make Canada the 51st state is all about metals and minerals. The new US administration reiterating its desire to buy Greenland, have thrust critical minerals into the public view like never before. Significant part of Ukraine, now occupied by Russia is mineral rich.

China is a big player in critical minerals extraction and processing. Chinese electric carmaker BYD acquired mineral rights for two plots of land in a lithium-rich part of Brazil in 2023, entering the mining business in its biggest market outside of China. BYD, which bought stakes in major Chinese miners, was one of six firms allowed to bid on a Chilean lithium project last year. China’s Ganfeng Lithium has begun producing lithium at its Mariana project in northern Argentina. Ganfeng is one of the world’s biggest producers of the white metal. Argentina, along with Chile and Bolivia, comprise Latin America’s so-called lithium triangle containing one of the world’s biggest reserves of the ultra-light metal. Two Chinese manufacturers have taken over a Nigerian company in 2023 and started building a lithium refinery. They brought financial clout and operating means to Nigeria’s nascent lithium industry, which has typically shipped raw ore to China for further treatment.

China unveiled a series of retaliatory measures against new US tariffs a fortnight ago, including restrictions on the export of tungsten, tellurium, bismuth, indium, and molybdenum, stating that export licenses will only be granted to companies complying with “relevant regulations.”

India imports almost all of its lithium, mostly from China and Hong Kong. The Indian government is exploring lithium reserves in Jammu and Kashmir. The government has amended the Mines and Minerals (Development and Regulation) Act, 2023 to auction lithium mines, and approved royalty rates for lithium, niobium, and Rare Earth Elements (REEs). The challenge is that Lithium reserves can take 6–8 years to become commercially productive. Lithium extraction requires specialized mining techniques. Open-pit mining, refining, and waste disposal can pollute water and soil.

Lithium Evolves as Critical Mineral

Lithium was discovered by Johan August Arfwedson, a Swedish chemist in 1817. The chemical element (symbol Li and atomic number 3), is a soft, silvery-white alkali metal. Under standard conditions, it is the least dense metal and the least dense solid element. Like all alkali metals, lithium is highly reactive and flammable, and must be stored in vacuum, inert atmosphere, or inert liquid such as purified kerosene or mineral oil. It exhibits a metallic lustre. It corrodes quickly in air to a dull silvery grey, then black tarnish.

It does not occur freely in nature, but occurs mainly in pegmatite minerals. Due to its solubility, it is present in ocean water and is commonly obtained from brines. Lithium metal is isolated electrolytically from a mixture of lithium chloride and potassium chloride. Because of its relative nuclear instability, lithium is less common in the solar system than 25 of the first 32 chemical elements. Lithium metal is soft enough to be cut with a knife.

The transmutation of lithium atoms to helium in 1932 was the first fully human-made nuclear reaction, and lithium deuteride serves as a fusion fuel in staged thermonuclear weapons. Lithium and its compounds have several industrial applications, including heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron, steel and aluminum production, lithium metal batteries, and lithium-ion batteries. These uses consume more than three-quarters of lithium production. Lithium-based drugs are useful as a mood stabilizer and antidepressant in the treatment of mental illness such as bipolar disorder.

It’s melting point of 180.50 °C and boiling point of 1,342 °C are each the highest of all the alkali metals while its density of 0.534 g/cm3 is the lowest. Apart from helium and hydrogen, as a solid it is less dense than any other element as a liquid, being only two-thirds as dense as liquid nitrogen (0.808 g/cm3). Lithium can float on the lightest hydrocarbon oils and is one of only three metals that can float on water, the other two being sodium and potassium.

Major Lithium Sites

Lithium is about as common as chlorine in the Earth’s upper continental crust, on a per-atom basis. Although lithium is widely distributed on Earth, it does not naturally occur in elemental form due to its high reactivity. The total lithium content of seawater is very large and is estimated as 230 billion tonnes, where the element exists at a relatively constant concentration of 0.14 to 0.25 parts per million (ppm). Higher concentrations approaching 7 ppm are found near hydrothermal vents.

Estimates for the Earth’s crustal content range from 20 to 70 ppm by weight. Lithium forms a minor part of igneous rocks, with the largest concentrations in granites. Granitic pegmatites also provide the greatest abundance of lithium-containing minerals, among others. At 20 mg lithium per kg of Earth’s crust, lithium is the 31st most abundant element. Lithium remains a comparatively rare element, although it is found in many rocks and some brines, but always in very low concentrations.

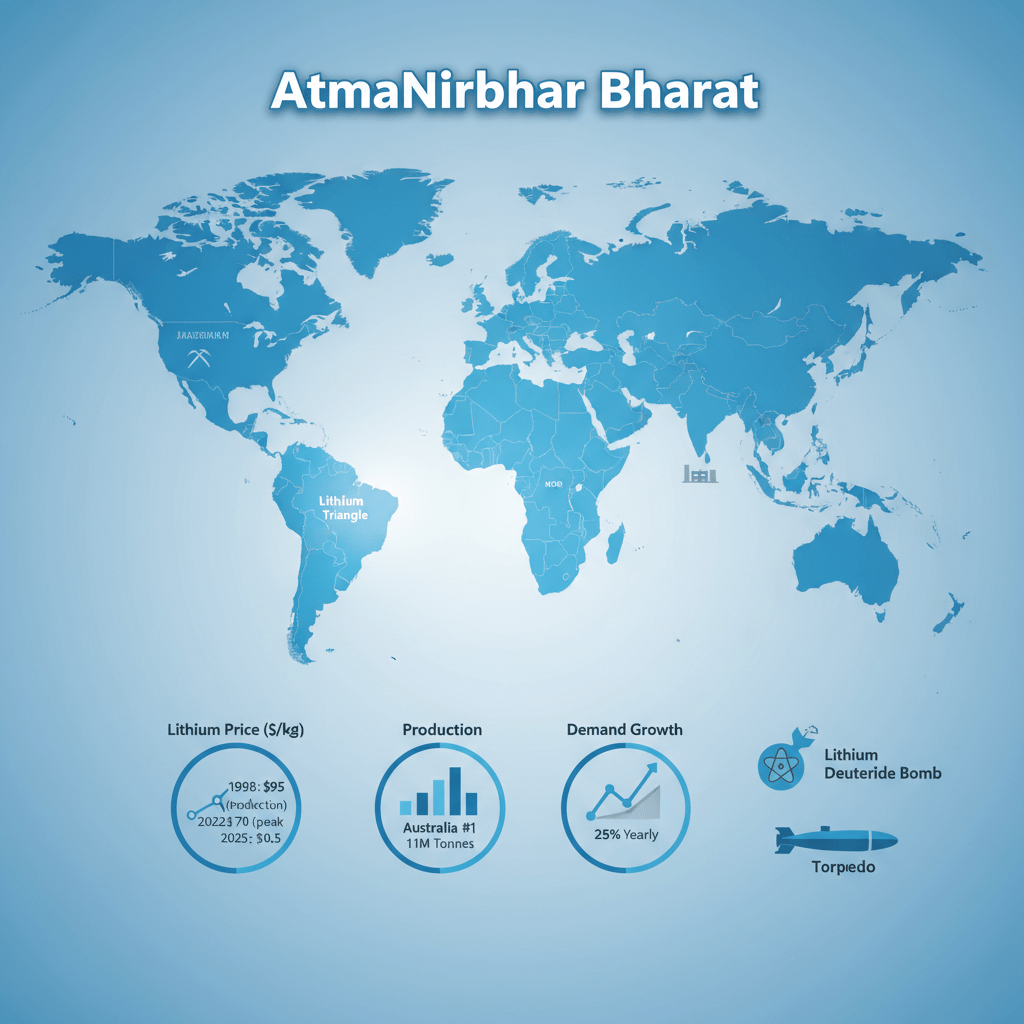

Chile is estimated to have the largest reserves by far (9.2 million tonnes), and Australia the highest annual production (40,000 tonnes). One of the largest reserve bases of lithium is in the Salar de Uyuni area of Bolivia, which has 5.4 million tonnes. Other major suppliers include Australia, Argentina and China. Lithium reserves are also known to be in Czech Republic and Finland. The US DoD estimated the lithium reserves in Afghanistan to amount to the ones in Bolivia and dubbed it as a potential “Saudi Arabia of lithium“.

Demand Increased during Cold War

The demand for lithium increased dramatically during the Cold War with the production of nuclear fusion weapons. Both lithium-6 and lithium-7 produce tritium when irradiated by neutrons, and are thus useful for the production of tritium by itself, as well as a form of solid fusion fuel used inside hydrogen bombs in the form of lithium deuteride. The US became the prime producer of lithium between the late 1950s and the mid-1980s. At the end, the stockpile of lithium was roughly 42,000 tonnes of lithium hydroxide.

After the end of the nuclear arms race, the demand for lithium decreased and the sale of department of energy stockpiles on the open market further reduced prices. Most of the mines closed or shifted their focus to other materials. But then, the development of lithium-ion batteries increased the demand for lithium and became the dominant use in 2007. With the surge of lithium demand in batteries in the 2000s, new companies have expanded brine isolation efforts to meet the rising demand.

Lithium Mine Production (tonnes) 2023

These are as per US Geological Survey (USGS) estimates. Lithium resources are deposits that have been discovered and studied, while lithium reserves are the portion of those deposits that can be economically extracted.

| Country | Production | Reserves | Resources |

| Argentina | 9,600 | 3,600,000 | 22,000,000 |

| Australia | 86,000 | 6,200,000 | 8,700,000 |

| Bolivia | 540 | – | 23,000,000 |

| Brazil | 4,900 | 390,000 | 800,000 |

| Canada | 3,400 | 930,000 | 3,000,000 |

| Chile | 44,000 | 9,300,000 | 11,000,000 |

| China | 33,000 | 3,000,000 | 6,800,000 |

| DR Congo | – | – | 3,000,000 |

| Germany | – | – | 3,800,000 |

| India | – | – | 5,900,000 |

| Mali | – | – | 890,000 |

| Mexico | – | – | 1,700,000 |

| Namibia | – | – | 230,000 |

| Peru | – | – | 1,000,000 |

| Portugal | 380 | 60,000 | 270,000 |

| Russia | – | – | 1,000,000 |

| Serbia | – | – | 1,200,000 |

| United States | 870 | 1,100,000 | 14,000,000 |

| Zimbabwe | 3,400 | 310,000 | 690,000 |

| Other countries | – | 2,800,000 | – |

| World total | 146,000 | 28,000,000 | 105,000,000+ |

The three countries of Chile, Bolivia, and Argentina contain a region known as the Lithium Triangle. The Lithium Triangle is known for its high-quality salt flats. Half the world’s known reserves are located in Bolivia along the central eastern slope of the Andes. The Democratic Republic of Congo is expected to be a significant supplier of lithium to the world with its high grade and low impurities. In Russia the largest lithium deposit Kolmozerskoye is located in Murmansk region. In 2023, Polar Lithium, a joint venture between Nornickel and Rosatom, has been granted the right to develop the deposit. The project aims to produce 45,000 tonnes of lithium carbonate and hydroxide per year and plans to reach full design capacity by 2030.

Lithium Pricing

In 1998, the price of lithium metal was about $95/kg. After the 2007 financial crisis, major suppliers dropped lithium carbonate price to single digit. Prices began rising again as global consumption also jumped to 300,000 metric tons a year by 2020 doubling that of 2016. In 2022 lithium price peaked at $70/Kg. Demand for lithium batteries has been growing at about 25 percent a year, outpacing the approximate 5 percent rise in lithium production. Yet, as of February 2025 it cost $10.5/kg.

Lithium Extraction Choices and Complexities

Lithium and its compounds were historically isolated and extracted from hard rock but by the 1990s mineral springs, brine pools, and brine deposits had become the dominant source in South America. By early 2021, much of the lithium mined globally came from either “spodumene, the mineral contained in hard rocks found in places such as Australia and North Carolina” or from the salty brine. The lithium concentration in the brine is raised by solar evaporation in a system of ponds. Low-cobalt cathodes for lithium batteries require lithium hydroxide rather than lithium carbonate and this comes better from rocks. The use of electrodialysis is used to extract lithium compounds from seawater (which contains lithium at 0.2 parts per million). This method offers significant cost savings, shorter timelines, and less environmental damage than traditional evaporation-based systems.

Lithium extraction can be fatal to aquatic life due to water pollution. It is known to cause surface water contamination, drinking water contamination, respiratory problems, ecosystem degradation and landscape damage. It also leads to unsustainable water consumption in arid regions (1.9 million liters per ton of lithium). Lithium extraction also leaves large amounts of magnesium and lime waste.

Lithium Applications

By 2021, most lithium is used to make lithium-ion batteries for electric cars and mobile devices. Lithium oxide is widely used as a flux for processing silica and producing ceramics and glass especially for ovenware. A typical lithium-ion battery can generate approximately 3 volts per cell, compared with 2.1 volts for lead-acid and 1.5 volts for zinc-carbon. Lithium-ion batteries, which are rechargeable and have a high energy density. Lithium soap has the ability to thicken oils, and it is used to manufacture all-purpose, high-temperature lubricating greases. Lithium compounds are also used as additives to foundry sand for iron casting to reduce veining.

Lithium has been found effective in assisting the perfection of silicon nano-welds in electronic components. Lithium compounds are used as pyrotechnic colorants and oxidizers in red fireworks and flares. Lithium hydroxide and lithium peroxide salts are most commonly used in confined areas, such as aboard spacecraft and submarines, for carbon dioxide removal and air purification. Lithium fluoride, artificially grown as crystal, is clear and transparent and often used in specialist optics for IR, UV and VUV (vacuum UV) applications. Lithium fluoride is sometimes used in focal lenses of telescopes. Lithium applications are used in more than 60% of mobile phones. Lithium is useful in the treatment of bipolar disorder.

Lithium Applications for Military and Nuclear

Lithium technology offers unique solutions to the combination of requirements imposed by military systems — low weight, low volume, long storage life, low life cycle cost, and immediate readiness over the full military environmental condition spectrum. Metallic lithium and its complex hydrides are used as high-energy additives to rocket propellants, or even as solid fuel. Lithium is used in torpedoes. Lithium hydride is used in thermonuclear weapons, where it serves as fuel for the fusion stage of the bomb. Lithium-6 is a source material for tritium production and as a neutron absorber in nuclear fusion. Lithium-7 has a use in nuclear reactor coolants. Lithium deuteride was the fusion fuel of choice in early versions of the hydrogen bomb.

India Securing Lithium Supply Chains

India is conscious of the importance of critical minerals, and need to develop and also secure its lithium supply chain to support transition to green energy and reduce strategic vulnerabilities. China makes up 60–70 percent of lithium refining capacity and a significant portion of lithium reserves. Their batteries are much cheaper due to scale of production. Till now there has been a significant dependence on Chinese imports. India has started encouraging investments and R&D and technology adoption. It has been looking for alternative sources and foreign partnerships. Lithium is critical for India’s economic growth and national security. India has finalised lithium agreements with Argentina and Australia. It is seeking technology from USA. Joint Ventures with friendly countries to strengthen global lithium supply chain management and reduce strategic vulnerabilities would be a good approach.

India does have unexplored reserves that need extraction and processing. Recent discoveries of new lithium reserves in Jharkhand, Rajasthan and Jammu and Kashmir in 2023 have attracted attention from government and private players. To leverage the deposits, the government has eased the mining process by allowing the auction of lithium mines. The decision opened the gates for private players to mine lithium, a shift from the mostly state-run companies previously engaged in the process.

Lithium is categorised as a ‘strategic’ mineral with 100 percent import dependence, placing it at the top of the priority list. Currently, domestic lithium-ion battery storage demand of 15 gigawatt hours (GWh) is being almost entirely met through imports of lithium-ion cells and batteries. In 2024, India imported lithium-ion batteries worth around $3 billion. Up from $384.6 million in 2019. By 2027, India‘s demand for lithium-ion batteries is expected to increase to 54 gigawatt hours (GWh), and to 127 GWh in 2030. In India’s Budget 2024, customs duty was removed on import of lithium, boost for domestic battery production.

In a major step forward for India’s advanced battery manufacturing sector, the Ministry of Heavy Industries (MHI), signed a Programme Agreement with Reliance New Energy Battery Limited (a subsidiary of Reliance Industries Limited) under the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) on February 17, 2025. Out of 50 GWh capacity, 40 GWh cumulative capacity has been awarded under the scheme. Global heavyweights such as Panasonic, LG Chem and Samsung are also setting up facilities. Government is supporting start-ups under ‘Mission LiFE’.

The Central Government is now empowered to exclusively auction mining lease and composite licence for 24 critical minerals which includes lithium. This vital to power the transition to a low-emission economy, and the renewable technologies that will be required to meet the ‘Net Zero’ commitment of India by 2070. All the steps are towards creating a reliable supply chain of these mineral and making an ‘AtmaNirbhar Bharat’ and contribute towards increased economic growth and national security.

Note: The article was originally written by the Author for The EurAsian Times on, February 23rd, 2025, it has since been updated.

Header Picture Credit: Author

Twitter: @AirPowerAsia